Explore The Finrate's top-rated fintech directory for expert reviews on leading fintech companies, payment solutions, and financial services.

-

84 Posts

-

49 Photos

-

0 Videos

-

Top Fintech Directory & Reviews | The Finrate - Expert Ratings at 7 Temasek Boulevard , #12-07 Suntec Tower 1 Singapore – 038987

-

Lives in singapore

-

From singapore

-

Studied 7 Temasek Boulevard , #12-07 Suntec Tower 1 Singapore – 038987 at

-

Male

-

Followed by 1 people

Recent Updates

-

Best Payment Gateway Providers Compared for 2025

Explore the top payment gateway providers for 2025 in this comprehensive comparison. Discover key features, pricing, security, and integration options to find the best solution for your e-commerce or small business needs. From industry leaders like Stripe and PayPal to emerging platforms, we break down the pros, cons, and performance to help you choose the ideal payment gateway for seamless, secure, and cost-effective transactions.

https://thefinrate.com/how-to-choose-the-best-payment-gateway-provider-a-complete-guide-for-2025/Best Payment Gateway Providers Compared for 2025 Explore the top payment gateway providers for 2025 in this comprehensive comparison. Discover key features, pricing, security, and integration options to find the best solution for your e-commerce or small business needs. From industry leaders like Stripe and PayPal to emerging platforms, we break down the pros, cons, and performance to help you choose the ideal payment gateway for seamless, secure, and cost-effective transactions. https://thefinrate.com/how-to-choose-the-best-payment-gateway-provider-a-complete-guide-for-2025/ THEFINRATE.COMHow to Choose the Best Payment Gateway Provider | TheFinRateDiscover how to choose the best payment gateway provider in 2025. Compare features, pricing, and India-specific options to boost conversions.0 Comments 0 Shares 337 Views 0 ReviewsPlease log in to like, share and comment!

THEFINRATE.COMHow to Choose the Best Payment Gateway Provider | TheFinRateDiscover how to choose the best payment gateway provider in 2025. Compare features, pricing, and India-specific options to boost conversions.0 Comments 0 Shares 337 Views 0 ReviewsPlease log in to like, share and comment! -

Discover the Top Payment Gateways for 2025

Explore the top payment gateways for 2025 in this comprehensive guide. Learn about the best platforms that ensure secure, fast, and seamless transactions for your business, from credit cards to cryptocurrencies. Discover key features like multi-currency support, fraud protection, and easy integration with popular e-commerce platforms. Compare fees, user experiences, and scalability to find the perfect fit for your needs. Whether you’re a small business owner, an online retailer, or a global enterprise, this guide highlights the top payment solutions to streamline your operations and boost customer satisfaction. Stay ahead in the digital economy with these cutting-edge payment gateways!

https://thefinrate.com/top-payment-gateways-for-secure-online-transactions-in-2025/Discover the Top Payment Gateways for 2025 Explore the top payment gateways for 2025 in this comprehensive guide. Learn about the best platforms that ensure secure, fast, and seamless transactions for your business, from credit cards to cryptocurrencies. Discover key features like multi-currency support, fraud protection, and easy integration with popular e-commerce platforms. Compare fees, user experiences, and scalability to find the perfect fit for your needs. Whether you’re a small business owner, an online retailer, or a global enterprise, this guide highlights the top payment solutions to streamline your operations and boost customer satisfaction. Stay ahead in the digital economy with these cutting-edge payment gateways! https://thefinrate.com/top-payment-gateways-for-secure-online-transactions-in-2025/ THEFINRATE.COMTop Payment Gateways for Secure Online Transactions in 2025Explore top payment gateways for secure online transactions in 2025. Compare features, pricing, and security for your business.0 Comments 0 Shares 157 Views 0 Reviews

THEFINRATE.COMTop Payment Gateways for Secure Online Transactions in 2025Explore top payment gateways for secure online transactions in 2025. Compare features, pricing, and security for your business.0 Comments 0 Shares 157 Views 0 Reviews -

The Best Payment Gateways for Small Businesses and Startups

Discover the best payment gateways tailored for small businesses and startups in 2025. This comprehensive guide compares the best options, highlighting their features, pricing, security, and ease of integration. Learn which payment gateways offer the flexibility and affordability growing businesses need to streamline transactions, boost customer trust, and scale efficiently. Perfect for entrepreneurs looking to optimize their online payment systems without breaking the bank.

https://thefinrate.com/top-rated-best-payment-gateways-in-fintech-2025/The Best Payment Gateways for Small Businesses and Startups Discover the best payment gateways tailored for small businesses and startups in 2025. This comprehensive guide compares the best options, highlighting their features, pricing, security, and ease of integration. Learn which payment gateways offer the flexibility and affordability growing businesses need to streamline transactions, boost customer trust, and scale efficiently. Perfect for entrepreneurs looking to optimize their online payment systems without breaking the bank. https://thefinrate.com/top-rated-best-payment-gateways-in-fintech-2025/ THEFINRATE.COMTop-Rated Best Payment Gateways in Fintech 2025 | TheFinRateExplore the top-rated payment gateways in fintech for 2025 with expert insights, features, and pricing to find the right fit for your business0 Comments 0 Shares 213 Views 0 Reviews

THEFINRATE.COMTop-Rated Best Payment Gateways in Fintech 2025 | TheFinRateExplore the top-rated payment gateways in fintech for 2025 with expert insights, features, and pricing to find the right fit for your business0 Comments 0 Shares 213 Views 0 Reviews -

Secure List of Payment Gateways for 2025 and Beyond

Discover our expertly curated Secure List of Payment Gateways for 2025 and Beyond, designed to empower businesses with reliable, safe, and efficient online transaction solutions. This comprehensive guide highlights top payment gateways that prioritize security, seamless integration, and global accessibility, ensuring your e-commerce platform thrives in an ever-evolving digital landscape. Whether you’re a small business or a global enterprise, find the perfect payment gateway to boost customer trust and streamline operations.

https://thefinrate.com/complete-list-of-payment-gateways-for-2025/Secure List of Payment Gateways for 2025 and Beyond Discover our expertly curated Secure List of Payment Gateways for 2025 and Beyond, designed to empower businesses with reliable, safe, and efficient online transaction solutions. This comprehensive guide highlights top payment gateways that prioritize security, seamless integration, and global accessibility, ensuring your e-commerce platform thrives in an ever-evolving digital landscape. Whether you’re a small business or a global enterprise, find the perfect payment gateway to boost customer trust and streamline operations. https://thefinrate.com/complete-list-of-payment-gateways-for-2025/ THEFINRATE.COMComplete List of Payment Gateways for 2025 | TheFinRateExplore the complete list of payment gateways for 2025. Compare features, benefits, & use cases to choose the best solution for your business.0 Comments 0 Shares 197 Views 0 Reviews

THEFINRATE.COMComplete List of Payment Gateways for 2025 | TheFinRateExplore the complete list of payment gateways for 2025. Compare features, benefits, & use cases to choose the best solution for your business.0 Comments 0 Shares 197 Views 0 Reviews -

How to Choose the Best Payment Gateway for Recurring Billing

Master the art of selecting the best payment gateway for recurring billing with this in-depth guide for 2025. Explore essential criteria, including robust automation, top-tier security with PCI compliance, seamless integration with popular subscription platforms, and transparent pricing structures. Learn how to evaluate scalability, multi-currency support, and user-friendly interfaces to ensure smooth, reliable recurring payments. Empower your business with the right payment gateway to enhance customer satisfaction, reduce churn, and drive operational efficiency.

https://thefinrate.com/best-payment-gateway-for-recurring-billing-in-2025/How to Choose the Best Payment Gateway for Recurring Billing Master the art of selecting the best payment gateway for recurring billing with this in-depth guide for 2025. Explore essential criteria, including robust automation, top-tier security with PCI compliance, seamless integration with popular subscription platforms, and transparent pricing structures. Learn how to evaluate scalability, multi-currency support, and user-friendly interfaces to ensure smooth, reliable recurring payments. Empower your business with the right payment gateway to enhance customer satisfaction, reduce churn, and drive operational efficiency. https://thefinrate.com/best-payment-gateway-for-recurring-billing-in-2025/ THEFINRATE.COMBest Payment Gateway for Recurring Billing in 2025Explore the best payment gateway for recurring billing —ideal for SaaS, subscriptions, and global payments.0 Comments 0 Shares 217 Views 0 Reviews

THEFINRATE.COMBest Payment Gateway for Recurring Billing in 2025Explore the best payment gateway for recurring billing —ideal for SaaS, subscriptions, and global payments.0 Comments 0 Shares 217 Views 0 Reviews -

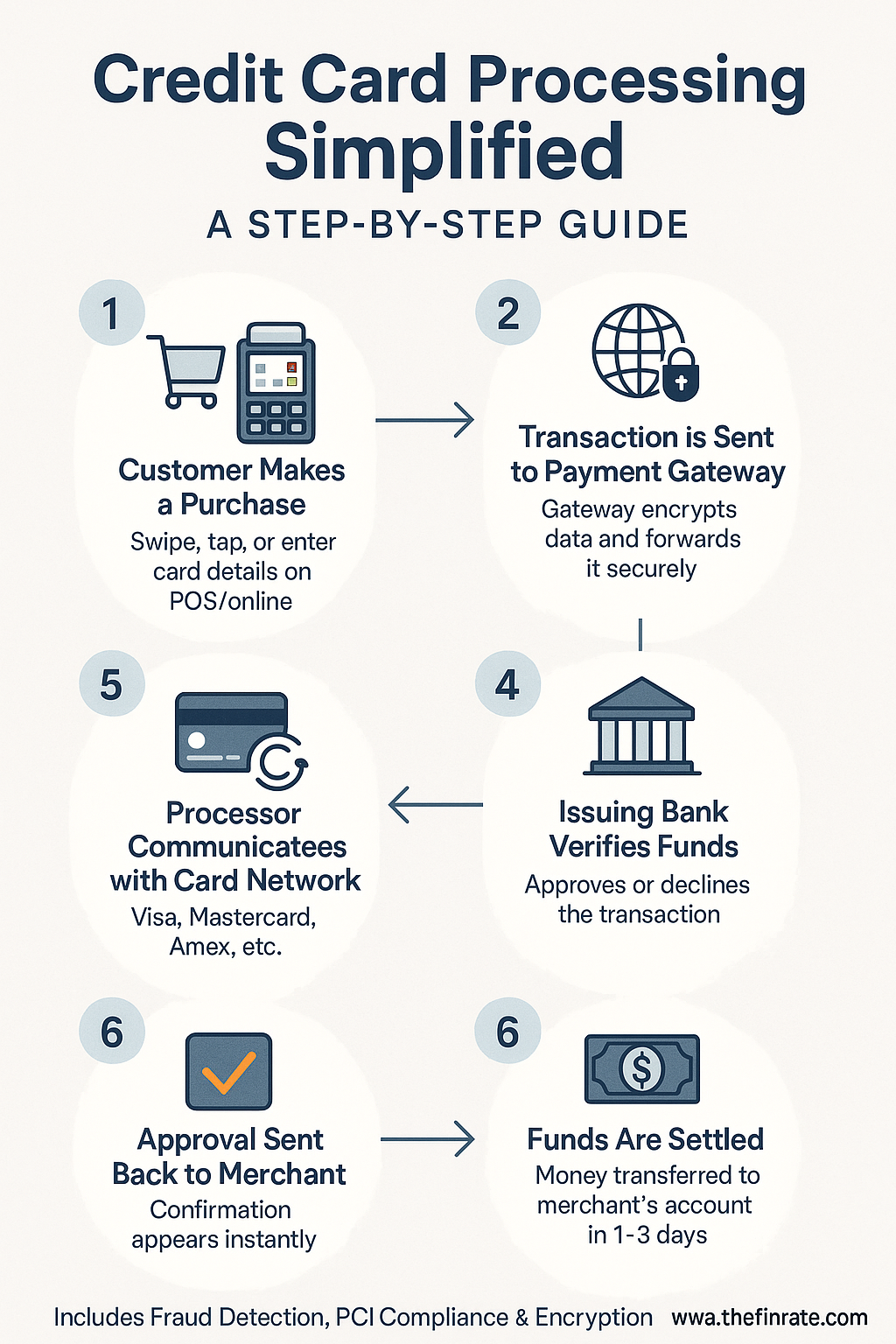

How Payment Processing Works: Step-by-Step Explained

Dive into how payment processing works with this detailed step-by-step guide, perfect for businesses and beginners in 2025. Explore the complete transaction journey, from customer payment initiation through secure payment gateways to final merchant account settlement. Understand the critical roles of payment processors, acquiring banks, and issuing banks, while learning about essential security measures like PCI compliance and encryption. Discover tips to optimize your payment system for faster, safer, and more efficient transactions, boosting customer trust and business success.

https://thefinrate.com/payment-processing-a-tech-deep-dive/How Payment Processing Works: Step-by-Step Explained Dive into how payment processing works with this detailed step-by-step guide, perfect for businesses and beginners in 2025. Explore the complete transaction journey, from customer payment initiation through secure payment gateways to final merchant account settlement. Understand the critical roles of payment processors, acquiring banks, and issuing banks, while learning about essential security measures like PCI compliance and encryption. Discover tips to optimize your payment system for faster, safer, and more efficient transactions, boosting customer trust and business success. https://thefinrate.com/payment-processing-a-tech-deep-dive/ THEFINRATE.COMPayment Processing: A Tech Deep Dive by TheFinRateExplore how payment processing works from start to finish. TheFinRate’s deep tech guide covers payment gateways, processors, & APIs.0 Comments 0 Shares 309 Views 0 Reviews

THEFINRATE.COMPayment Processing: A Tech Deep Dive by TheFinRateExplore how payment processing works from start to finish. TheFinRate’s deep tech guide covers payment gateways, processors, & APIs.0 Comments 0 Shares 309 Views 0 Reviews -

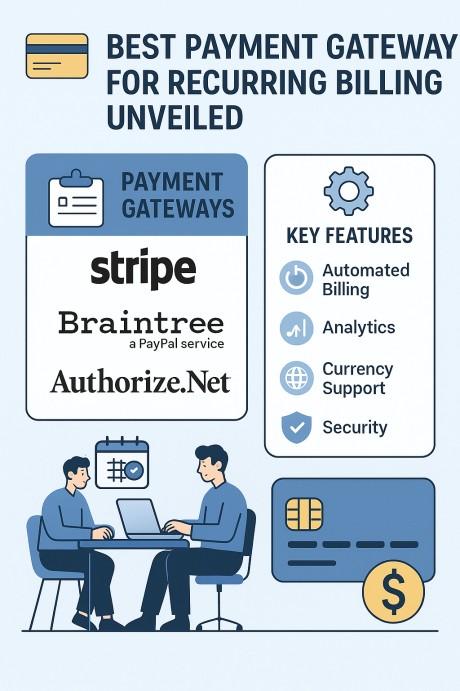

Best Payment Gateway for Recurring Billing Unveiled

Explore the best payment gateways for recurring billing, unveiled for seamless subscription management. Compare top providers with low fees, secure transactions, and easy integrations, perfect for small businesses, e-commerce, and startups looking to automate payments efficiently.

https://thefinrate.com/what-are-the-best-payment-gateways-for-recurring-billing/Best Payment Gateway for Recurring Billing Unveiled Explore the best payment gateways for recurring billing, unveiled for seamless subscription management. Compare top providers with low fees, secure transactions, and easy integrations, perfect for small businesses, e-commerce, and startups looking to automate payments efficiently. https://thefinrate.com/what-are-the-best-payment-gateways-for-recurring-billing/0 Comments 0 Shares 244 Views 0 Reviews -

Best Payment Gateways for Recurring Billing in 2025

Explore the best payment gateways for recurring billing in 2025! Find top solutions for seamless subscriptions, cost-effective plans, and easy setups tailored for businesses, startups, e-commerce, freelancers, SaaS, nonprofits, and high-risk industries. Streamline billing, support multi-currency, and grow with reliable tools featuring dunning management, secure transactions, scalability, 24/7 support, fraud prevention, and advanced analytics. Simplify your payment process, reduce churn, boost revenue, and enhance retention with trusted gateways offering API integrations, customizable plans, real-time reporting, automated retries, compliance tools, flexible pricing, and global reach. Optimize recurring revenue streams, improve cash flow, and ensure customer satisfaction with user-friendly platforms designed for success in a competitive digital economy.

https://thefinrate.com/what-are-the-best-payment-gateways-for-recurring-billing/

Best Payment Gateways for Recurring Billing in 2025 Explore the best payment gateways for recurring billing in 2025! Find top solutions for seamless subscriptions, cost-effective plans, and easy setups tailored for businesses, startups, e-commerce, freelancers, SaaS, nonprofits, and high-risk industries. Streamline billing, support multi-currency, and grow with reliable tools featuring dunning management, secure transactions, scalability, 24/7 support, fraud prevention, and advanced analytics. Simplify your payment process, reduce churn, boost revenue, and enhance retention with trusted gateways offering API integrations, customizable plans, real-time reporting, automated retries, compliance tools, flexible pricing, and global reach. Optimize recurring revenue streams, improve cash flow, and ensure customer satisfaction with user-friendly platforms designed for success in a competitive digital economy. https://thefinrate.com/what-are-the-best-payment-gateways-for-recurring-billing/ THEFINRATE.COMWhat are the best payment gateways for recurring billing?Explore the best payment gateways tailored for smooth and secure recurring billing solutions. Find the perfect fit for your business.0 Comments 0 Shares 411 Views 0 Reviews

THEFINRATE.COMWhat are the best payment gateways for recurring billing?Explore the best payment gateways tailored for smooth and secure recurring billing solutions. Find the perfect fit for your business.0 Comments 0 Shares 411 Views 0 Reviews -

Credit Card Processing Simplified: A Step-by-Step Guide

A simple step-by-step infographic that explains how credit card processing works—from customer purchase to final fund settlement. Ideal for merchants and fintech learners seeking a clear overview of the transaction flow.

https://thefinrate.com/best-credit-card-processing-for-small-business/Credit Card Processing Simplified: A Step-by-Step Guide A simple step-by-step infographic that explains how credit card processing works—from customer purchase to final fund settlement. Ideal for merchants and fintech learners seeking a clear overview of the transaction flow. https://thefinrate.com/best-credit-card-processing-for-small-business/0 Comments 0 Shares 190 Views 0 Reviews -

Simplify Your Business with the Best Merchant Account Solutions

Unlock the best merchant account solutions to simplify payment processing and grow your business. Compare reliable, affordable providers tailored for small businesses, e-commerce, startups, retailers, and high-risk industries. Streamline transactions, enhance security, and boost efficiency with fast setup, competitive rates, scalable tools, and 24/7 support. Discover top-rated services to accept payments seamlessly, reduce costs, and drive success with trusted, user-friendly platforms designed for your needs.

https://thefinrate.com/what-is-a-merchant-account-and-how-does-it-work/Simplify Your Business with the Best Merchant Account Solutions Unlock the best merchant account solutions to simplify payment processing and grow your business. Compare reliable, affordable providers tailored for small businesses, e-commerce, startups, retailers, and high-risk industries. Streamline transactions, enhance security, and boost efficiency with fast setup, competitive rates, scalable tools, and 24/7 support. Discover top-rated services to accept payments seamlessly, reduce costs, and drive success with trusted, user-friendly platforms designed for your needs. https://thefinrate.com/what-is-a-merchant-account-and-how-does-it-work/0 Comments 0 Shares 488 Views 0 Reviews -

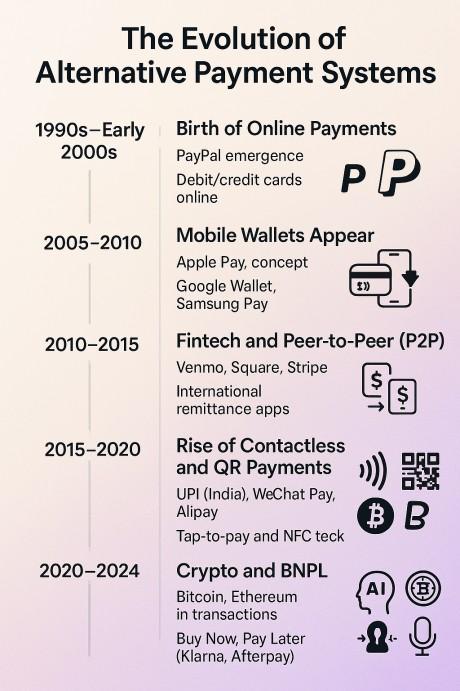

The Evolution of Alternative Payment Systems

This infographic explores the evolution of alternative payment systems, tracing their journey from the rise of PayPal and online card payments in the 1990s to today's cutting-edge solutions like cryptocurrencies, Buy Now Pay Later (BNPL), and AI-powered transactions. It highlights key milestones, including mobile wallets, QR code payments, and the growing role of digital innovation in reshaping how we pay.

https://thefinrate.com/what-are-alternative-payment-methods/The Evolution of Alternative Payment Systems This infographic explores the evolution of alternative payment systems, tracing their journey from the rise of PayPal and online card payments in the 1990s to today's cutting-edge solutions like cryptocurrencies, Buy Now Pay Later (BNPL), and AI-powered transactions. It highlights key milestones, including mobile wallets, QR code payments, and the growing role of digital innovation in reshaping how we pay. https://thefinrate.com/what-are-alternative-payment-methods/0 Comments 0 Shares 627 Views 0 Reviews -

Why Neo Banking Is Perfect for Startups in 2025

Discover why Neo Banking is the ideal financial solution for startups in 2025. Learn how digital-first banks offer flexibility, lower costs, instant account setup, and powerful financial management tools to help new businesses grow faster and operate more efficiently. Neo Banks provide tailored services like expense tracking, seamless international payments, and easy access to credit — empowering entrepreneurs to focus on scaling their ventures without traditional banking hassles. Explore how Neo Banking is reshaping the future of startup finance.

https://thefinrate.com/the-future-of-neo-banking/Why Neo Banking Is Perfect for Startups in 2025 Discover why Neo Banking is the ideal financial solution for startups in 2025. Learn how digital-first banks offer flexibility, lower costs, instant account setup, and powerful financial management tools to help new businesses grow faster and operate more efficiently. Neo Banks provide tailored services like expense tracking, seamless international payments, and easy access to credit — empowering entrepreneurs to focus on scaling their ventures without traditional banking hassles. Explore how Neo Banking is reshaping the future of startup finance. https://thefinrate.com/the-future-of-neo-banking/0 Comments 0 Shares 381 Views 0 Reviews -

Why Crypto Payments Matter: Facts and Insights

Explore why crypto payments are revolutionizing finance in "Why Crypto Payments Matter: Facts and Insights." This infographic covers key benefits like speed, security, global reach, and lower costs — essential insights for businesses and investors in 2025.

https://thefinrate.com/best-crypto-payment-gateways/Why Crypto Payments Matter: Facts and Insights Explore why crypto payments are revolutionizing finance in "Why Crypto Payments Matter: Facts and Insights." This infographic covers key benefits like speed, security, global reach, and lower costs — essential insights for businesses and investors in 2025. https://thefinrate.com/best-crypto-payment-gateways/0 Comments 0 Shares 173 Views 0 Reviews -

How to Choose a Secure Credit Card Processing Provider

Choosing a secure credit card processing provider is crucial for protecting your business and customer data. In this guide, discover essential factors to consider, such as PCI compliance, fraud prevention tools, encryption standards, and transparent pricing. Learn how to evaluate providers, compare features, and select the best solution that ensures security, reliability, and smooth transactions for your small business.

https://thefinrate.com/best-credit-card-processing-for-small-business/

How to Choose a Secure Credit Card Processing Provider Choosing a secure credit card processing provider is crucial for protecting your business and customer data. In this guide, discover essential factors to consider, such as PCI compliance, fraud prevention tools, encryption standards, and transparent pricing. Learn how to evaluate providers, compare features, and select the best solution that ensures security, reliability, and smooth transactions for your small business. https://thefinrate.com/best-credit-card-processing-for-small-business/0 Comments 0 Shares 154 Views 0 Reviews -

The Benefits of Going Cashless with Digital Wallets

This infographic highlights the key benefits of going cashless with digital wallets, including enhanced security through encrypted transactions, quick and convenient payments, the ability to pay anytime from anywhere, and easy expense tracking for better budgeting.

https://thefinrate.com/top-10-digital-wallet-apps-in-2025/The Benefits of Going Cashless with Digital Wallets This infographic highlights the key benefits of going cashless with digital wallets, including enhanced security through encrypted transactions, quick and convenient payments, the ability to pay anytime from anywhere, and easy expense tracking for better budgeting. https://thefinrate.com/top-10-digital-wallet-apps-in-2025/0 Comments 0 Shares 612 Views 0 Reviews -

Exploring the World of Alternative Payment for Businesses

Discover how alternative payment methods are revolutionizing business transactions. From digital wallets and BNPL to cryptocurrencies, explore the benefits and types of payment solutions that can streamline your business operations. Learn how adopting these payment options can boost sales, improve customer satisfaction, and expand your global reach in the competitive digital landscape. Stay ahead of trends, enhance payment security, and cater to evolving customer preferences by integrating the right alternative payment solutions into your business strategy.

https://thefinrate.com/what-are-alternative-payment-methods/

Exploring the World of Alternative Payment for Businesses Discover how alternative payment methods are revolutionizing business transactions. From digital wallets and BNPL to cryptocurrencies, explore the benefits and types of payment solutions that can streamline your business operations. Learn how adopting these payment options can boost sales, improve customer satisfaction, and expand your global reach in the competitive digital landscape. Stay ahead of trends, enhance payment security, and cater to evolving customer preferences by integrating the right alternative payment solutions into your business strategy. https://thefinrate.com/what-are-alternative-payment-methods/0 Comments 0 Shares 237 Views 0 Reviews -

Fintech News Highlights: From Blockchain to AI in Finance

Fintech News Highlights: From Blockchain to AI in Finance offers a quick look at the latest trends shaping finance — from blockchain innovations to AI-driven solutions, digital payments, and emerging fintech tech. Stay updated in minutes.

https://thefinrate.com/news/Fintech News Highlights: From Blockchain to AI in Finance Fintech News Highlights: From Blockchain to AI in Finance offers a quick look at the latest trends shaping finance — from blockchain innovations to AI-driven solutions, digital payments, and emerging fintech tech. Stay updated in minutes. https://thefinrate.com/news/0 Comments 0 Shares 194 Views 0 Reviews -

Top Benefits of Using Crypto Payments in 2025

Explore the top benefits of using crypto payments in 2025 and how they’re transforming the way businesses transact. From reduced fees and instant global transfers to increased transparency and fraud prevention, this guide breaks down the key advantages of accepting cryptocurrencies like Bitcoin, Ethereum, and stablecoins. Whether you’re a small business or an enterprise, understanding crypto payments can help you future-proof your operations and stay ahead in the digital economy. Perfect for business owners, fintech enthusiasts, and developers looking to integrate smarter, more secure payment options.

https://thefinrate.com/best-crypto-payment-gateways/Top Benefits of Using Crypto Payments in 2025 Explore the top benefits of using crypto payments in 2025 and how they’re transforming the way businesses transact. From reduced fees and instant global transfers to increased transparency and fraud prevention, this guide breaks down the key advantages of accepting cryptocurrencies like Bitcoin, Ethereum, and stablecoins. Whether you’re a small business or an enterprise, understanding crypto payments can help you future-proof your operations and stay ahead in the digital economy. Perfect for business owners, fintech enthusiasts, and developers looking to integrate smarter, more secure payment options. https://thefinrate.com/best-crypto-payment-gateways/0 Comments 0 Shares 257 Views 0 Reviews -

How Payment Processing Powers Seamless Transactions

Discover how modern payment processing systems work to ensure fast, secure, and hassle-free transactions for both businesses and customers. From card authorization to settlement and fraud detection, this guide explains each step that powers seamless digital payments. Learn how payment gateways, processors, and merchant accounts work together to make every swipe, tap, or click a smooth experience. Perfect for business owners, fintech enthusiasts, and curious consumers!

https://thefinrate.com/what-is-payment-processing-how-it-works-and-advantages/How Payment Processing Powers Seamless Transactions Discover how modern payment processing systems work to ensure fast, secure, and hassle-free transactions for both businesses and customers. From card authorization to settlement and fraud detection, this guide explains each step that powers seamless digital payments. Learn how payment gateways, processors, and merchant accounts work together to make every swipe, tap, or click a smooth experience. Perfect for business owners, fintech enthusiasts, and curious consumers! https://thefinrate.com/what-is-payment-processing-how-it-works-and-advantages/0 Comments 0 Shares 110 Views 0 Reviews -

The Ultimate Guide to Choosing the Best Digital Wallet

Looking for the best digital wallet to match your lifestyle and financial needs? This ultimate guide breaks down the top digital wallets of 2025 with in-depth comparisons, key features, pros and cons, and expert insights. Whether you’re a frequent online shopper, a business owner, or just starting your digital finance journey, learn how to choose the right wallet based on security, usability, platform compatibility, and more. Stay ahead of the cashless trend and make informed decisions with our comprehensive digital wallet guide.

https://thefinrate.com/top-10-digital-wallet-apps-in-2025/The Ultimate Guide to Choosing the Best Digital Wallet Looking for the best digital wallet to match your lifestyle and financial needs? This ultimate guide breaks down the top digital wallets of 2025 with in-depth comparisons, key features, pros and cons, and expert insights. Whether you’re a frequent online shopper, a business owner, or just starting your digital finance journey, learn how to choose the right wallet based on security, usability, platform compatibility, and more. Stay ahead of the cashless trend and make informed decisions with our comprehensive digital wallet guide. https://thefinrate.com/top-10-digital-wallet-apps-in-2025/0 Comments 0 Shares 190 Views 0 Reviews

More Stories